Buy a house in Italy – what do you need and the costs

What do I need to buy a house in Italy?

To buy a house in Italy it is not necessary to have Italian citizenship, but it is essential to have a tax code, that is, a code that serves to uniquely identify natural persons and other subjects other than natural persons in their relations with entities and public administrations of the Italian State. To obtain the tax code, simply fill in a form provided by the Inland Revenue where all personal data will be written. Then it will be necessary to go to the Inland Revenue office with the completed form, there an employee will take care of generating a new tax code which will be unique and will contain all the applicant’s data.

Normally the real estate agency through delegation deals with assigning a tax code to its customers, otherwise it is also possible to go directly.

In addition to the tax code, it is necessary to have a valid identity document with you and, for the countries in which it is requested, also a visa or residence permit.

What are the costs for those who buy a home?

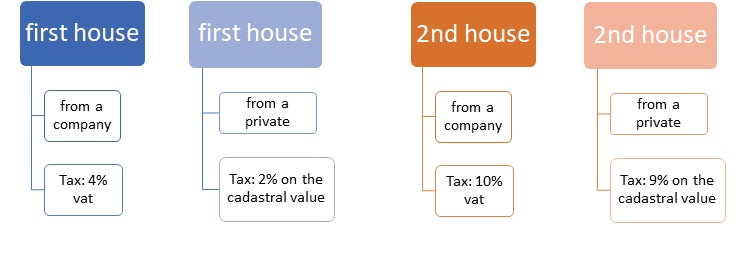

When you go to buy a house in Italy you have to pay a house tax. The tax depends on several factors: if you buy as a first or second home and if you buy from a private individual or a company. Taxes vary even if the buyer is an individual or a company. By purchasing as a first home, it will be necessary to bring the permanent residence to the purchased property within 6 months of the notarial deed. Here is a summary scheme of taxes assuming that the buyer is a private individual:

In the event that the buyer is a company, the taxation is different and a precise quote must be requested from the Notary who will do the notary act.

The other purchase costs are the following:

The notary

Usually the cost of the notary can vary between € 2,500.00 € 3,000.00. When requesting a quote from the notary, the notary provides us with a figure inclusive of his fee and the taxes mentioned above. In the case of purchasing the property by making a mortgage loan, the notary’s price will be higher since the notary will have to stipulate in addition to the deed of sale also the deed of mortgage between the buyer and the bank.

The real estate agency

The cost of the real estate agency usually amounts to 3% of the sale price + 22% VAT, unless otherwise agreed with the real estate agent.

Registration fees

When making a written offer or a preliminary sale to buy a house in Italy, these documents must be registered with the Revenue Agency within 20 days of the conclusion of the contract. Costs vary based on the deposit paid, on advance payments and whether the purchase is subject to VAT or not. Usually the costs are around € 400.00 but depend on the conditions of the proposal, the agency will estimate the registration costs once the contract has been entered into and will go to the Revenue Agency to register it.

Translation costs

To stipulate a notarial deed it is necessary that all participants speak the Italian language, otherwise, it will be necessary to have an official translator, who will translate the notarial deed in advance and will assist the customer during the stipulation, translating all that is said. Translation costs may vary depending on the length of the document, if it is one or more documents, it usually starts from a figure of approximately € 500.00.